Factors To Consider Before You Buy a Property

Buying a property is one of the most important and complex purchases anyone can make and for first time home buyers, it’s like navigating a minefield. This article will help with 10 tips to consider before you even start an online search.

Choose The Right Location

In real estate, there is a statement that says “location, location and location”, location has a significant weight on the current and future value of your property, you can spend a lot of money improving your property but because of where your property is located you may even fail to recoup half of your renovations expenditure. List down the possible neighbourhoods and conduct extensive research on property values.

List Down Your Needs

If you start your home buying journey by scouring online for properties without listing down your needs you will likely buy a bigger property you do not need. In the long term will you need a 3 bedroom house or 2 bedroom house. List many other features you need. From the list of the needs you have now you can find a property that meets your needs and align with your budget.

Proximity To Work and Good Schools

Total costs incurred by owning a property include fuel costs to and from work, with rising prices of fuel you will realise one property’s asking price may look expensive but the total cost of owning that house which includes fuel costs may be way too low than a property with a lower asking price.

Rates and Levies

COGTA defines municipal property rates as a Cent amount in the Rand levied on the market value of the immovable property (that is, land and buildings). When you are buying a sectional title property such as a property in a complex, the board corporate will agree on a levy to be charged. Levy covers the costs incurred when managing the complex and may include municipal rates and taxes, limited building insurance coverage, as well as repairs and maintenance. Some complexes may have levies going as high as R5000 per month. It is one of factors to consider before you buy a property of sectional title scheme.

Availability of Public Transport

It is very important to note the availability of public transport especially when you are not mobile and alternatives to mass transport such as e-hailing services. You have to consider how accessible is the property.

Budget

The first point to note is how much can you afford and this you can get pre-approved by banks, this gives you a clue on how much loan the banks are willing to lend you. The amount you have been pre-approved does not necessarily mean is the amount you can afford. You can get pre-approved for R2 million rands but with your future expenditures, you may afford R1.2 million. Stick to your budget.

ZOPA (Zone of Possible Agreement) & BATNA (Best Alternative To a Negotiated Agreement)

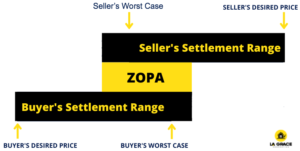

You have your budget set, your pre-approval ready, finished online marketplace searches and narrowed down the properties you like. ZOPA is the range in a negotiation in which two or more parties can find common ground.

BATNA (Best Alternative To a Negotiated Agreement)

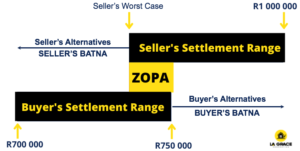

The buyer needs property and is negotiating with the seller to purchase his property. The seller offers to sell his property to the buyer for R1 000,000. The buyer scours through lagraceproperties.co.za and finds a similar property to which he assigns a rand value of R750,000. The buyer’s BATNA is R750,000 – if the seller does not offer a price lower than R750,000, The buyer will consider his best alternative to a negotiated agreement. The buyer is willing to pay up to R750,000 for the property but would ideally want to pay R700,000 only. As illustrated below illustrated below:

In short, when you negotiate you must have alternatives and you must have a walk away value, do not negotiate with a walkaway point.

Garage Space

It is important to consider the available parking space a property has to offer, especially when you buy into a sectional title scheme. You must check how many parking spaces the property has to offer because you don’t want to end up buying a property that has one garage or carport space when you have two cars.

Crime Reports Of The Location

Your family’s safety is a top priority, and knowing as much as possible about a neighbourhood can help determine whether or not the new area is safe. A crime report will help you budget for security alarm installation costs and see if it will have a significant impact on your home insurance.

Property Transfer Costs

When an offer has been accepted special attorneys will be responsible for processing the paperwork and some of the costs related include transfer duty, VAT, conveyancer’s fees e.tc, remember all these costs are paid by the buyer and you have a budget for these costs before you make an offer to purchase.