Finance Linked Individual Subsidy Programme (FLISP) is a new housing scheme introduced by the department of human settlement via the National Housing Finance Corporation (NHFC). In South Africa, you can be too rich to qualify for a government free housing scheme but too poor to get a home loan.

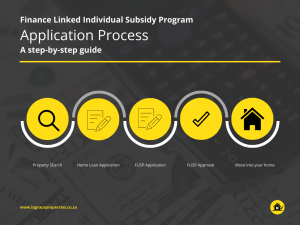

FLISP Application Procedure

- Property Search ( find the property you like and make an offer)

- Apply for a home loan

- Apply for FLISP

- FLISP payout

What is Finance Linked Individual Subsidy Programme (FLISP)?

FLISP is a housing finance scheme from the department of housing that allows low and middle-income households to bridge the shortfall between the home loan approved by the bank and the house selling price or to reduce the initial home loan through a deposit payment. The amount paid by FLISP varies depending on the applicant’s salary but ranges from R27 960 – R121 626.

Who Qualifies

- Income between R3 501 – R22 000

- First Time home buyer

- Never benefited from government housing scheme before

Where Can You Use the Finance Linked Individual Subsidy Programme?

- New or old residential property

- Vacant serviced land

- Build on a tribal land available through Permission To Occupy (PTO)

Where Can You Can’t the Finance Linked Individual Subsidy Programme?

However, FLISP does not cover transfer costs such as conveyancer fees and transfer duty.

How Finance Linked Individual Subsidy Programme Works

Covering Home Loan Shortfall

A shortfall is when the bank or home loan provider approves your loan, but the loan is less than the property selling price.

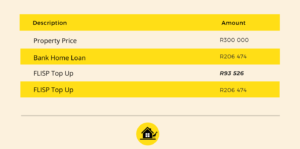

(Scenario 1)

An individual earning R9 000 / month wishes to buy a property for R300 000, the bank only approved a home loan of R206 474.

- Property Price R300 000

- Bank Loan R206 474

- FLISP To-up R93 526

- Home loan due R206 474

Reduce Monthly instalment

When the bank has fully approved your home loan, you can apply for FLISP to cover the deposit. Deposit money leads to lower and affordable monthly instalments.

(Scenario 2)

An individual earning R9 000 / month wishes to buy a property for R300 000, the bank only approved a home loan of R300 000.

- Property Price R300 000

- Bank Loan R300 000

- FLISP deposit R93 526

- Home loan due R206 474

How To Apply

1. Property Search

- The first step is to get pre-qualification from a bank or use the affordability calculator to check how much you qualify.

- Begin to search for properties in that range you qualify

- When you find a property you like, make an offer.

2. Apply For Financing

- Remember to use accreditated home loan banks

- Shop around find one with favourable terms and interests.

- Loan is approved

3. Apply For Finance Linked Individual Subsidy Programme

- Complete the FLISP application form. (FLISP FORM).

- Contacts (info@nhfc.co.za, 011 644 9800)

4.

Finance Linked Individual Subsidy Programme Approved and Payment

- deposit is paid into a trust account

- Paid directly into your home loan account

- All done after a bond is registered

Required Documents

CERTIFIED COPIES are required as supporting documents when applying for FLISP:

- RSA bar-coded Identity Document (ID)

- Bar-coded Permanent Residence Permit (where applicable)

- Birth Certificates/RSA ID’s of all financial dependants (where applicable)

- Proof of Foster Children Guardianship (where applicable)

- Marriage Certificate, Civil Union Certificate or Cohabiting Affidavit*, Proof of Partnership (applicable)

- Divorce Settlement (where applicable)

- Spouse’s Death Certificate (where applicable)

- Proof of Monthly Income

- Home Loan Approval

- Agreement of sale for the residential property

- Building Contract and Approved Building Plan (where applicable

If you have any questions give us a shout will assist you throughout the whole application process. this is a great opportunity which you should take advantage of and become a homeowner.

hey there and thank you for your information – I have certainly picked

up anything new from right here. I did however expertise a few technical

issues using this website, since I experienced to reload the

site a lot of times previous to I could

get it to load correctly. I had been wondering if your web hosting is OK?

Not that I am complaining, but slow loading instances times will sometimes affect your placement

in google and could damage your high-quality score if advertising and marketing with

Adwords. Well I am adding this RSS to my e-mail and could look out for much more of your

respective intriguing content. Make sure you update this again soon..

Najlepsze escape roomy

Thank you for your feedback. We’re committed to enhancing user satisfaction and addressing any issues you may encounter on our website to create a smoother experience.